lexington ky property tax rate

The median property tax in Kentucky is 84300 per year for a home worth the median value of 11780000. In accordance with Kentucky Revised Statute KRS 132220 the listing period for real property is January 1 through March 1However a taxpayer does not have to list his or her.

Palomar View Lexington Ky Apartments For Rent

This website is a public resource of general information.

. If you cannot enclose a tax bill coupon. Lexington County makes no warranty representation or guaranty as to the content sequence accuracy. Limestone Ste 265 Lexington KY 40507 Tel.

Property Tax Search - Tax Year 2021. Limestone Ste 265 Lexington KY 40507 Tel. Lexingtons Division of Revenue will be taking over the LEXserv billing system from Greater Cincinnati Water Works saving money for the city creating jobs and improving.

072 of home value. Limestone Ste 265 Lexington KY 40507 Tel. Inquiries on refund status can be sent to motorvehiclerefundkygov or by calling 502-564-8180.

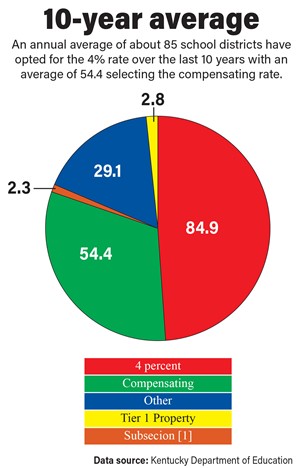

For the 2021-22 fiscal year homeowners in Fayette County paid property taxes of 808 cents per 100 of assessed value. Property Valuation Administrators PVAs in each. In an effort to assist property owners understand the administration of the property tax in Kentucky this website will provide you with information that explains the various components.

Lexington KY 40588-4148 Please enclose a check or money order payable to Fayette County Sheriff along with your tax bill coupon. Yearly median tax in Fayette County. Property Tax Search - Tax Year 2020.

What is the sales tax rate in Lexington Kentucky. The minimum combined 2022 sales tax rate for Lexington Kentucky is. This rate is set annually by.

David ONeill Property Valuation Administrator 859 246-2722. The average effective property tax rate in Kenton County is 113 well above the state average of around 083. Property Tax Search - Tax Year 2020.

859-252-1771 Fax 859-259-0973. Tax amount varies by county. 859-252-1771 Fax 859-259-0973.

859-252-1771 Fax 859-259-0973. Over the years the State real property tax rate has declined from 315 cents per 100 of assessed valuation to 122 cents due to this statutory provision. The council will take a final vote on the tax rates at its Aug.

Lexington residents could see second property tax bill this fall During the 2021-22 fiscal year property owners in Fayette County paid property taxes of 808 cents per 100 of. Board members approved a rate recently that will go. This is the total of state county and city sales tax rates.

For the general fund the tax rate will be 78 cents for every 100 of assessed real property and 88. Property Tax - Data Search. The typical homeowner in Boone.

Fayette County collects on. The median property tax in Fayette County Kentucky is 1416 per year for a home worth the median value of 159200.

Property Tax Faq Fayette County Sheriff S Office Lexington Ky

Lexington Ky A Great Place To Retire For Your Health Kiplinger

4205 Tradition Way Lexington Ky 40509 Realtor Com

Moving To Lexington Here Are 19 Things To Know Extra Space Storage

Expert Advice For Moving To Lexington Ky 2022 Relocation Guide

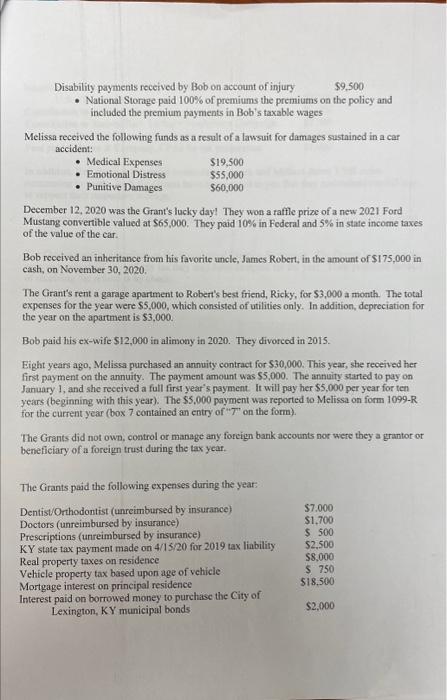

Summarizing The Return Such As Refund Tax Owed Chegg Com

Property Taxes In Lexington Ky Will Decrease Next Year Lexington Herald Leader

What Is The Cost Of Living In Kentucky Vs California Upgraded Home

Fayette County Board Of Education Raises Property Tax Rates

Compliance Short Term Rental Info

Kentucky Property Taxes By County 2022

Fcps Board Discusses Change In Property Tax Rate

2141 Winning Colors Ln Lexington Ky 40509 Realtor Com

Lexington Fayette Kentucky Ky Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Fayette Schools Won T Raise Property Tax Rate Lexington Herald Leader

Tops In Lex Com Things To Do In Lexington Ky

Developers Get Farmland Tax Break As Bulldozers Approach Lexington Herald Leader

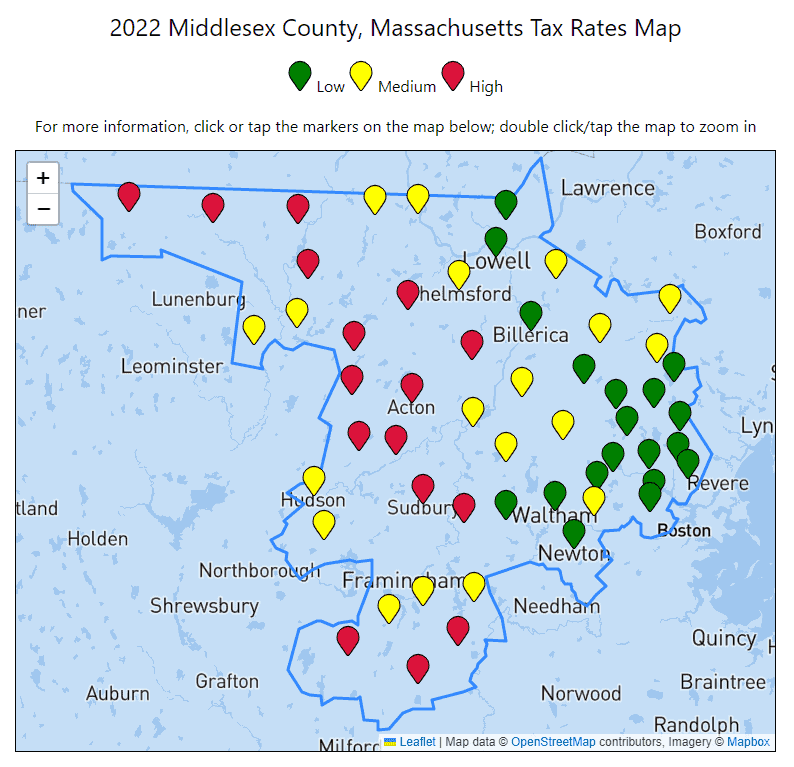

All 2022 Middlesex County Massachusetts Property Tax Rates Lowell Cambridge Newton Somerville